I Won't Give Up On Upstart. Here's Why.

An extreme deep dive into the company paving the way for fair & affordable credit.

Disclaimer

This report is not intended to be construed as financial advice. I have spent hundreds of hours analyzing Upstart. Here, I have written a deep dive into why I am bullish on not only Upstart stock but the good Upstart is doing in expanding access to affordable credit across the globe.

There is a common misconception that Upstart is a "predatory lender," but this is untrue. In this article, I will debunk this claim, highlight the positive aspects of Upstart's business, and make a strong case for why its stock price could continue to rise. I own Upstart stock, and I like the company. There is undeniable bias within. I hope you enjoy what I've put together.

1.) The Problem with FICO

FICO scores were introduced in 1989 and have become the predominant metric for determining creditworthiness. In 2023, a strong 3-digit credit score derived from five specific variables remains a critical factor in loan approval decisions. These variables are categorized with weightings: payment history (35%), debt (30%), length of credit history (15%), new credit (10%), and credit mix (10%). However, it is time for the credit industry to embrace disruption and reassess creditworthiness using more contemporary and comprehensive criteria. Solely relying on these five outdated metrics doesn’t provide an honest picture of an individual's financial standing. These metrics directly discriminate against younger borrowers and immigrants with no credit history.

In the last few decades, remarkable progress has been achieved in various aspects of human society:

Population: The global population has grown by 54.7%, from 5.2 billion to 8.05 billion, showcasing significant demographic changes.

Healthcare: Strides in healthcare have led to a substantial reduction in Malaria-related deaths, approximately 23%, and the eradication of Malaria in numerous countries. The treatment of HIV/AIDS has also improved significantly (source: ourworldindata.org).

Education: There has been a notable increase in school attendance nationally, and the US government allocated over $194 billion towards education in 2023 (source: usaspending.gov).

Technology: The advent of the internet and the proliferation of the World Wide Web has connected individuals globally, with approximately 85% of American adults relying on daily online interactions (source: Techjury).

Environmental Protection: Efforts to combat environmental issues have yielded positive results, with reduced air pollution in many nations and a growing emphasis on Environmental, Social, and Governance (ESG) reporting. Additionally, conservation measures have stabilized the number of endangered species while more people actively participate in recycling and environmental preservation.

Despite these impressive advancements and the overall progress of humanity, access to credit has remained largely unchanged. Surprisingly, only 48% of Americans have access to prime credit, despite 80% having never defaulted on any credit product (source: Upstart). It is evident that the credit industry needs to evolve and embrace a more inclusive and forward-thinking approach to assessing individuals' creditworthiness, taking into account the transformative developments in various spheres of human life.

2.) Early Days & Founders

Upstart was founded in 2012 by Dave Girouard, Paul Gu, and Anna Counselman. Girouard had been interviewing college students and found that many had entrepreneurial aspirations but were taking stable jobs because they needed help accessing affordable credit. Upstart's initial business model was an income share agreement (ISA), which allowed individuals to receive a loan from Upstart in exchange for giving the company a small portion of their future income. However, the ISA business model was ultimately unsuccessful due to regulatory issues and a lack of demand.

"Young people are potentially rich and cash poor," Dave Girouard.

In 2014, with just a few months of cash left, Upstart pivoted to a new business model based on artificial intelligence (AI). Led by Paul Gu, Upstart developed an AI model that could accurately predict a person's income and the likelihood they would default on a personal loan. Over the past nine years, Upstart has continued working on this model, which now trains on over 100 billion cells of performance data and an average of 90,000 new loan repayments added daily.

Upstart's AI-powered lending platform has successfully provided millions of people with affordable credit. They have also been praised for their innovative lending approach and commitment to using data to improve financial inclusion.

Let’s meet the founders. Thank you Upstart for providing the following information.

Dave Girouard

Prior to Upstart, Girouard began his career as a software developer at Accenture before moving on to Apple as a product manager. In 2004, he joined Google, where he held various roles, most notably, President of Google Enterprise. In this role, he helped build what became Google Cloud. Girouard is a graduate of Dartmouth College, where he earned a degree in engineering sciences and computer engineering. He also holds an MBA from the University of Michigan.

Paul Gu

Gu is a co-founder of Upstart and has served many roles, most recently as Chief Technology Officer and a member of the board of directors. Gu has a background in quantitative finance and built his first algorithmic trading strategies on the Interactive Brokers API at the age of 20. He previously worked in risk analysis at the D.E. Shaw Group, a hedge fund. During college, Gu led underwriting for two non-profit microlenders in the United States. He studied economics and computer science at Yale University, and he was a Thiel Fellow.

Anna Counselman

Counselman co-founded Upstart in 2012 and is currently the Head of Business Operations. Before Upstart, Anna led Gmail Consumer Operations at Google, where she helped scale the business from 150 million to 450 million users. She also launched the global Enterprise Customer Programs team. Anna received the White House Champion of Change award and was recognized as one of Silicon Valley Business Journal's 40 under 40. She graduated Summa Cum Laude from Boston University with a BA in Finance and Entrepreneurship.

3.) Upstart’s Business Model & Products

What is Upstart?

Put simply, Upstart is an AI lending marketplace that uses artificial intelligence and machine learning to connect borrowers and lenders alike. By leveraging banks’ low cost of capital and close customer relationships, Upstart is able to offer lower APRs than traditional lenders while better assessing the risk of default. Upstart is able to offer loans to more borrowers at lower APRs, while having lower delinquency and default rates.

Upstart primarily works with personal unsecured loans, which are predominantly used for credit card refinancing. Recently, Upstart has announced plans to further dip their toes into the ABS market beyond just auto. This comes with the announcement of a HELOC product, a home-equity line of credit, which is counter-cyclical to personal loans.

Kudos to Brad

for writing a fantastic Upstart deep dive article some time ago. I am going to reference it a few times here in this report. When thinking about TAM, total addressable market, Brad’s point really encompasses everything I want to say. Brad writes, “Per TransUnion — there is roughly $4.2 trillion outstanding in total American credit. Unsecured personal loans — Upstart’s primary niche — is the fastest expanding piece of consumer lending, with growth rates of 8% in the 12 months leading into the pandemic. Standard & Poor’s expects this market to double from 2021 to 2024, representing an accelerated 26% CAGR over that period.”(StockMarketNerd). Below is what Upstart considers their TAM to be.Q1 2023.

Upstart estimates its TAM as $4 trillion dollars annually. Read that again. IF they capture 1% of this, they will have $42 billion in yearly revenue.

In traditional times, Upstart does not carry credit risk. They outsource customers and sell loans to bank partners who then hold that loan on their balance sheet. The upside for Upstart is unlimited, as they can originate in theory every loan in existence. Of course, that will never happen, but the point is Upstart is structured in a way to grow extremely fast.

Upstart’s claim to fame is its ability to tap a market of borrowers who are being unfairly denied credit by legacy lenders. Per Upstart’s ESG report, “In 2021 the Upstart model approved: 43% more black borrowers and 46% more Hispanic borrowers than a traditional model, at APR's that were respectively 24% and 25% lower on average than a traditional model,”(Upstart).

Upstart is NOT predatory.

They are tapping a huge market that has massive profitability and PR benefits. The data shows that Upstart approves 173% more borrowers at the same default rate and experiences 53% fewer defaults at the same approval rate.

Upstart Q1 2023.

How can you argue this as predatory?

I know what most of you are going to say. “The APRs are way too high!!!”

Upstart offers APRs between 4.60% and 35.99%. Anything pushed above that threshold is struck down and the CFO, Sanjay, said that was a large issue in preventing loans from being originated as of late. (Explains in part why Upstart’s conversion rate has fallen.) Here’s what many are missing. Upstart personal loans are unsecured. That means they have no collateral. If a borrower defaults, their credit score is really only what is impacted. They may have a debt collector bother them for years, but realistically it isn’t going anywhere.

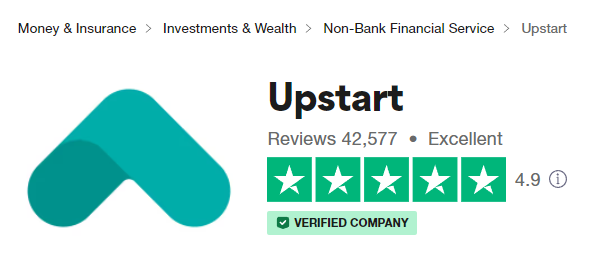

So of course unsecured loans are going to have higher APRs. Upstart is giving people who have been denied access to credit a lifeline. People love the product too! Just take a quick glance at their Trustpilot rankings.

Borrowers are paying back these loans at rates sufficient enough for Castlelake to give Upstart up to $4 billion in committed capital funding. This is not a case of borrowers getting “an easy loan,” leaving a good review, and then never paying.

Upstart borrowers pay their loans back at higher rates than FICO.

To call Upstart predatory is simply unjust.

Upstart, Q1 2023.

I also have an “outlandish” claim I would like to make regarding Upstart’s business model. Think about what propels the American economy. Credit. Americans have more debt than most citizens from other countries, but they also have a higher standard of living. Access to credit is essential for people to live their lives. While we enter what many believe to be a treacherous and recessionary world, Upstart’s ability to give fair and affordable access to credit to the underserved could help propel the economy out of any turmoil. Capital infusion is necessary to help businesses thrive and for prolonged commerce to take place. Without affordable credit, it becomes much harder for the economy to operate. Just a thought.

Now, onto products.

1.) Machine Learning & AI Credit Underwriting Model.

As of Q1 2023, “Upstart models train on over 100 billion cells of performance data with an average of 90,000 new loan repayments added each business day,”(Upstart). Upstart uses over 1,600 variables when evaluating one’s credit; that’s a lot more than FICO, which only uses 5. These variables include transaction data, macroeconomic data, (Upstart just announced the UMI index, more on that later), education and more.

Something interesting to note is a story Girouard shared about his time working at Google. When looking over someone’s resume, Girouard would not only look at their GPA, but he would look at the trajectory of it. For instance, say two applicants had the same 3.5 GPA, but one applicant has seen their GPA rise over the years, while the other has seen theirs fall. Dave says someone with a continuously improving GPA would be held in higher regard. It’s possible that these little tidbits of analysis make up the backbone of Upstart’s models.

But how important is each data point? Once again, I’m going to reference Brad

and his work here. Brad writes, “One may question how imperative the 1598th and 1599th variables actually are to the credit decision — and that skepticism would be well placed. No single variable is all that important in isolation — you can remove any one of your choice (including the FICO score) and have the same level of predictability within Upstart’s software. The real progress comes from the difficult process of teasing out and relating 1600 variables in tandem, in real time and with seamless scale. That’s what this ML model does and how Upstart has approached uncovering America’s large Hidden Prime cohort,”(StockMarketNerd). Brad raises some interesting questions about the future of credit. Legacy lenders use FICO and simply are not able to keep up with the complexity and developing situation that is the modern economy. Machine learning models, on the other hand, are able to adapt to new data and identify new patterns instantaneously.However, there are some challenges in using machine learning for credit scoring. They can be difficult to interpret. This means that it can be difficult to understand why a machine-learning model made a particular prediction. (Something I assume Paul Gu, Head of Product, is working on with the team).

Upstart’s machine learning model can eliminate bias, to the best one can, by analyzing data objectively without any human emotion or stereotyping. Additionally, the more variables and data you use to evaluate creditworthiness, the more borrowers you come across who are well-suited for a loan. This will help to ensure that borrowers can get the loans they need, and it will help protect lenders from losses.

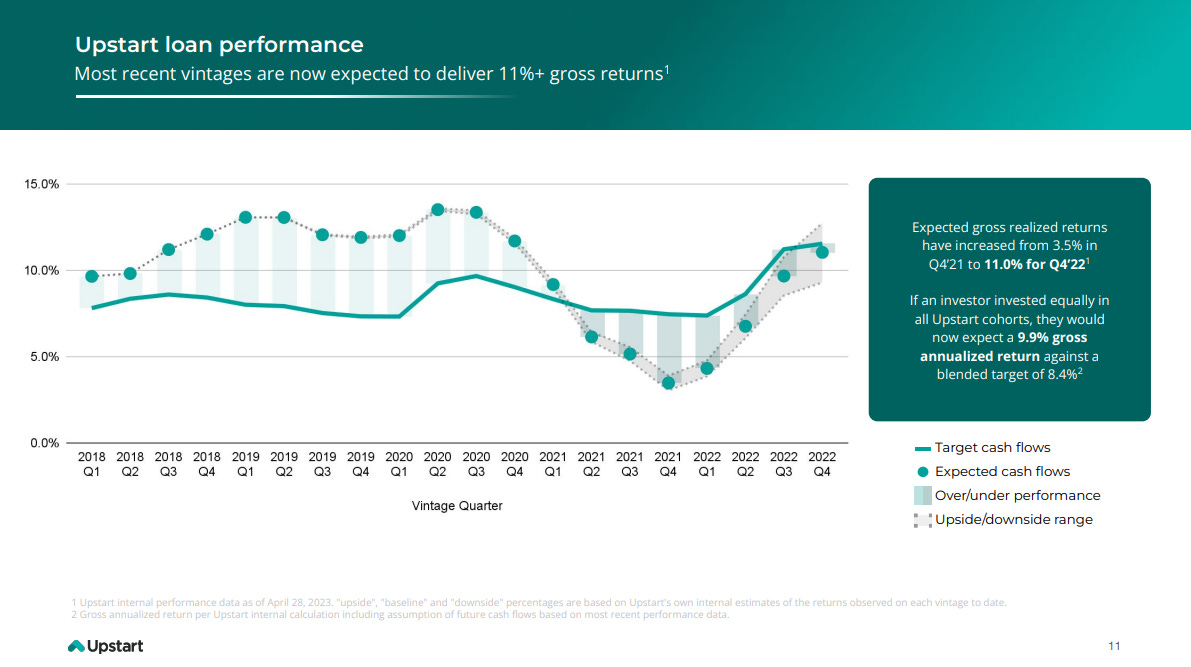

As of Q1 2023, Upstart has originated more than $32 billion in loans, with 84% now being fully automated. That is powerful. Upstart’s models are only going to get smarter. The more data they consume, the more accurate they can be. How are loans performing you may ask?

Q1 2023.

Quite well. Upstart is calling bottom on their performance and expects vintage returns to rise. Keep in mind, for this next bull cycle, they have more partners and more funding. (Upstart had 57 bank partners in Q1 of 2022. They now have 99 in Q1 of 2023, that’s a 73.68% increase).

To clarify, I do not know the ins and outs of how Upstart’s model works. I’m sure that information is out there, but it is in a language I can not understand. (That is compsci jargon. I am not smart enough to understand all of that at this point :(. I don’t think it’s quite like the blackbox Palantir, but I’m sure they hide a lot of their information to deter competition. I’ll go into why legacy banks can’t compete with Upstart shortly.

2.) Upstart Auto

Upstart auto incorporates all the great benefits of Upstart’s unsecured personal lending product. This includes leveraging AI and ML to evaluate risk better and increase access to credit. Here are a few things about Upstart’s auto program that make it special.

a.) Digital Finance: Enables a frictionless signing and contracting process, with automated verification, more loan approvals, and next-day funding powered by Upstart’s AI – and no new sales process required for dealers.

b.) Online Sales: Enables the completion of a car purchase entirely online, including financing and e-signing contract documents.

c.) Upstart funded greater than 20% of the total funded loans at participating dealerships

d.) When presented with an Upstart loan offer, borrowers choose Upstart 42% of the time.

Upstart, Q4 2022

The data doesn’t lie. Here’s another fact.

“Borrowers saved an average $5,851 over the life of the loan with Upstart Auto refinancing”(Upstart).

Wait, I thought Upstart was a predatory lender? So you’re telling me they approve more borrowers, save them money and make banks money? This is the power of leveraging AI and eliminating bias.

Gone are the days of sitting across from some old dude trying to sell you a POS car so he can get his commission.

Here’s another benefit of Upstart’s auto product. Auto loans are countercyclical to unsecured personal loans. Why? Because they are ABS, asset-backed securities. There is collateral. This makes auto loans less risky for lenders and, therefore, more likely to be made during economic downturns. The contrary is true for unsecured personal loans, which have no collateral. (This is a big reason Upstart’s revenue dropped off a cliff).

Oh wait, but it gets even better. So yeah, Upstart got demolished in 2022. Its share price and revenue took a nose dive. But, the team has since developed a strategy that will allow them to be less cyclical in future downturns. What doesn’t kill ya makes you stronger, right?

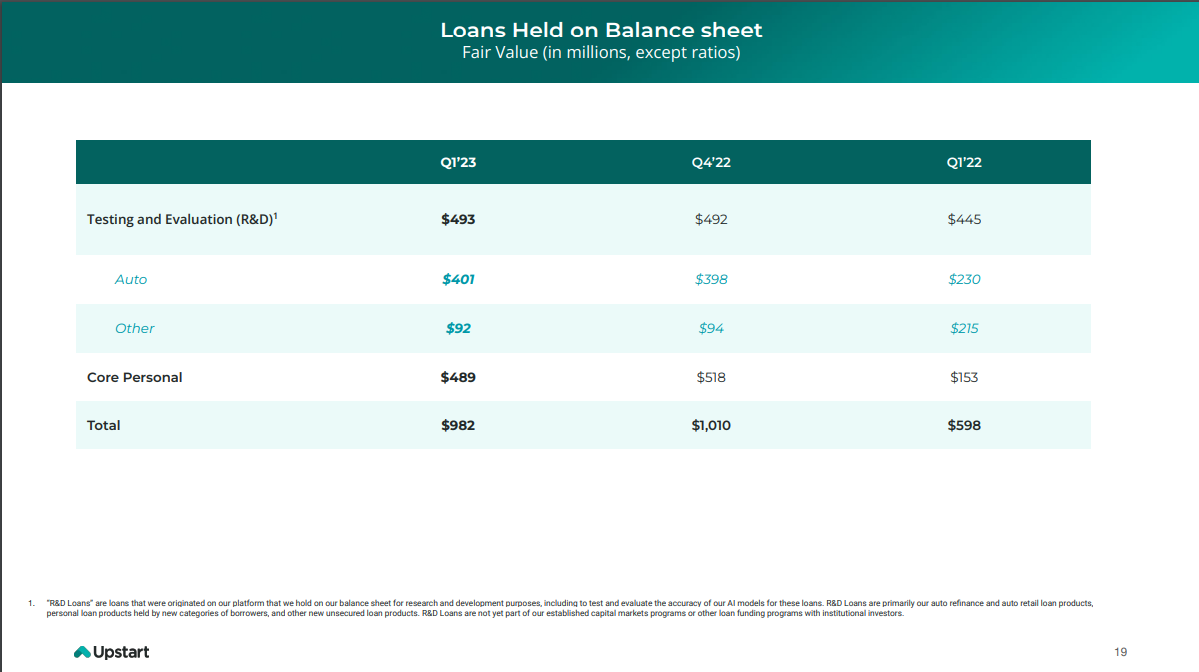

Q1 2023

40% of the loans Upstart holds on its balance sheet are in the ABS markets. This lowers the amount of risk they truly have. These loans will be easier to sell. With R&D increasing over 120% to $110 million dollars in Q1 of 2023, it would be misguided to say Upstart is giving out “easy loans.” The simple truth is this; Upstart is building an auto product that stabilizes their business and saves consumers money. They are further looking to reduce their cyclicality by instituting HELOC loans, which we will now discuss.

P.S. Girouard recently revealed that Upstart’s auto program may have more in the works!

3.) HELOC

HELOC, home equity line of credit, loans are secured by the borrower’s house. Once again, this is countercyclical to Upstart’s primary market, which is unsecured personal lending.

A good friend of mine, Eddie, Frugalbuck on Twitter, recently applied for a HELOC loan through a local credit union he has worked with for 15 years. It took over 6 weeks for the process to be completed.

Upstart claims to be able to do this in 4-5 DAYS.

It is too early to draw large conclusions about this product, as it was only just announced, but I do have two thoughts I want everyone to hear.

a.) As already mentioned, HELOC loans will help Upstart’s business become less cyclical.

b.) HELOC borrowers have a home, most of Upstart’s customers applying for unsecured personal loans and using them for credit card refinancing are less affluent (I am assuming many don’t own homes) and therefore, Upstart is expanding their total customer base and brand recognition.

4.) Upstart Macro Index - UMI.

The Upstart Macro Index is a new way Dave & team are measuring the impact of the macro economy on the performance of Upstart’s unsecured personal loans. In short, the higher this number is, the worse it is for Upstart. As you can see, this number has risen substantially, making it harder for Upstart to operate as it is a cyclical business by nature. (They’re working on it, okay!!).

4.) How Does Upstart Make Money?

Remember, Upstart is not a lender and not a bank. They do not earn revenue from interest income but rather from fees.

Upstart charges it’s banking partners 3 main types of fees, which include referral, platform, and servicing fees.

Upstart collects a referral fee when they send a borrower from Upstart.com to a banking partner who then originates the loan.

*Do you see how this is extremely scalable? Upstart can refer countless borrowers to countless bank partners and collect countless fees.

Platform fees are usually paid by the borrower to the bank, basically loan origination fees, who then give those back to Upstart.

Here’s the real kicker, loan servicing fees are anywhere between .5-1% on the outstanding balance.

The fees are a percentage of the outstanding loan balance, which means that they will increase as the loan balance increases.

The fees are paid on an ongoing basis, which means that Upstart will continue to earn revenue from them as long as the loans are outstanding.

The fees are a source of recurring revenue for Upstart, which means that they are not dependent on origination fees alone.

The fees provide Upstart with a steady stream of income, which can help the company weather economic downturns and other challenges.

Upstart is a company that can grow extremely quickly with bank partners who are willing to originate loans. As previously mentioned, Upstart announced they received up to $4 billion in committed capital funding from Castlelake and are working towards securing more.

It will become easier to raise capital as the macro economy improves, which it will in time. We can argue over the semantics of when, but as long as Upstart survives, which we have no reason to believe they won’t, they will benefit from this eventually.

5.) Share Structuring

Upstart currently has a float of roughly 70.86 million shares. Of that, 16.05% of shares are held by insiders, 37.58% are held by institutions and 37.65% of the float is short(Yahoo Finance).

This is an extremely shareholder-friendly setup. With a beta of 1.56, Upstart is certainly volatile. But, that does not mean it is risky. Volatility is one’s friend as it creates many great opportunities.

Many will point to insider sales as another sign to be bearish. What’s comical about this is that almost all sales have been pre-planned. In fact, the only indirect transaction since Q1 2023 earnings on May 9th was a 2,000 share buy at $19.93 by Cooper Whorton, who sits on the board of directors. (That purchase has since doubled in value).

Upstart also announced a $400 million dollar share buyback program in Q4 of 2021. By the end of 2022, Upstart had repurchased 5.9 million shares ~ $178 million dollars at an average share price of $30.17.

They bought back some cheap shares.

Although stock-based compensation, SBC, as a percent of revenue has increased, one has to wonder what could happen if they execute the remaining $222 million dollar buyback while their stock has 37% short interest and improving fundamentals.

Note: As revenue begins to accelerate again, it will be much tougher for SBC to make up a larger portion of revenue without increasing significantly.

6.) What Went Wrong?

When you couple extreme cyclicality and a market that is priced for perfection, in retrospect, it was pretty obvious Upstart’s share price was going to take a hit.

With the recent macroeconomic hurricane, and rates rising 19-fold in under one year (thanks for the information Cathie Wood), Upstart had trouble selling loans they originated and stuck them on the balance sheet. This gave them credit risk and temporarily made them much more of a lender. This was the catalyst for the 60% drop during Q1 on May 9th, 2022.

Ultimately, management missteps and hubris caused Upstart to fall more than it should’ve. Management was completely wrong, and shareholder trust, as well as Upstart’s share price, took a massive hit. Below was Upstart’s attempt to reassure investors that rising rates, “will not have a meaningful impact on our business,”(Upstart). Let’s take a look at what they got wrong.

Here’s what Upstart management predicted would happen.

a.) Upstart predicted a normalization of default rates in November of 2021.

Q1 2022 vs Q1 2023

Upstart’s own data showed that this was not the case. In fact, default rates for Upstart's most subprime borrowers, risk grade E-, have risen by 80% year-over-year. This is a significant increase, but it is lower than the 96% increase for FICO's most subprime borrowers. This suggests that Upstart's risk assessment model still performs better than FICO's.

“Rising absolute default rates that are correctly predicted and price are not a bug, but in fact a feature of our platform.”

This statement is true to some degree. Given the rapid rise in interest rates, Upstart’s ability to limit default/delinquency rises at a lower rate than FICO while primarily dealing with riskier borrowers and unsecured personal loans is quite impressive. Albeit it did not appear to work very well in 2021-2022, I believe in the next bull cycle, which could be rapidly approaching, Upstart’s ability to have collected data during a bear market coupled with increased automation could lead to even fewer defaults. Why? Because as Upstart’s model undergoes new upgrades, 23 were done in Q1 2023, their AI becomes even more proprietary and harder to replicate. It also performs better as it has more information to pull from.

b.) “An increase in the Fed rate does not translate directly to higher cost of funding for our bank partners,”(Upstart).

Upstart made quite the rosy assumption here. There are a number of factors that can affect the cost of funding for banks, including the level of liquidity in the market as well as the “riskiness” of the loans they hold. Even with great artificial intelligence and risk assessment, Upstart primarily deals with unsecured personal loans. These loans are risky by nature simply because they aren’t backed by an asset. This leads to higher APRs, especially when rates rise, which can spook borrowers and institutions. (When rates rise, APRs also get pushed beyond acceptable thresholds, resulting in a lower conversion rate for Upstart.)

It’s quite possible that upon the first couple of interest rate increases from Jerome Powell and the Fed, there was still so much liquidity post-COVID that Upstart’s banking partners did not feel a higher cost of funding at the beginning. This likely changed pretty quickly as the Fed stepped up the pace at which they were increasing rates. The slight lag between policy being enacted versus when it is felt caused Upstart’s management team to pat themselves on the back a little too soon.

Banks are risk-averse by nature. Well, at least they are supposed to be (nice call in 2008 Michael Burry), so Upstart should’ve been preparing for the worst-case scenario. Once more, although Upstart’s default rates rose significantly through the Fed tightening FICO, they did so at a slower pace than FICO.

Imagine how hard it would be to convince a bank to switch from FICO to Upstart. Legacy banks have been using FICO for decades and even when presented with concrete evidence that Upstart’s risk assessment is better and produces more approvals with lower APRs and lower delinquency rates, banks refuse to switch. Throw in a macroeconomic hurricane, especially for unsecured personal loans, and the writing was kind of on the wall. Upstart and team should’ve prepared for this better and they know that.

c.) “Any decrease in loan demand at the margin from borrowers reacting to higher nominal interest rates will be more than offset by growing demand for credit in the broader economy as stimulus evaporates as evidenced by recovering credit card balances”(Upstart).

This was wrong for multiple reasons.

I. The Fed increased rates faster and higher than Upstart expected. (I should note that almost everyone was caught off guard to some degree. After raising by 75 BPS in June of 2022, Chair Powell said he did not expect moves of this size to be common. He then raised by 75 bps again at three consecutive meetings.) Here’s a funny video I made about Powell & the Fed’s taper tantrum.

II.) Sticky inflation as well as a sell off in the stock market made banks and credit institutions risk off. Add in a war in Ukraine, and fear was even more amplified.

There was yet again another unforeseen challenge for Upstart.

III.) They did not see the inevitable coming, which would be tagging loans on the balance sheet. As liquidity dried up and banks went risk-off, Upstart had no one to sell loans to.

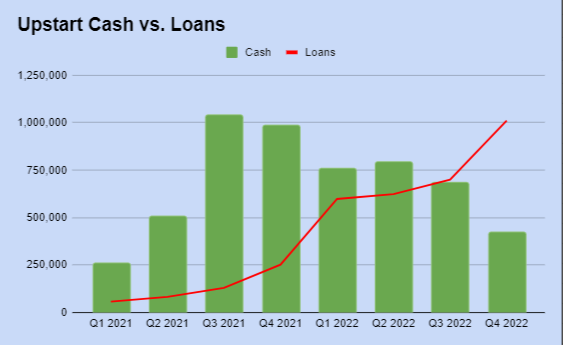

Upstart is a firm believer in its model’s ability to underwrite accurately, so they kept originating loans without demand and putting them on its books with hopes of selling them soon. That did not happen fast enough, and the result disappointed investors. In Q1 of 2022, loans on the books jumped 131% to $604.40 million dollars.

In Q2 they would jump another 3.9% to $628.50 million dollars. The trend continued throughout year end. Depleting cash levels added to what were now bankruptcy concerns. See the quick Excel illustration I’ve made below.

What steps did Upstart take to switch this trajectory?

Upstart fired 20% of its workforce.

Upstart raised at least $4 billion in committed capital funding.

Upstart announced the beginning of a HELOC product, home equity line of credit. This, along with their auto program (which we already went in depth on), is counter cyclical. (People tend to borrow against assets (ABS) in hard times and take unsecured loans in good times). Upstart has a plan to return to adjusted EBITDA breakeven in Q2 and soon after achieve profitability through fewer employees and more automation.

Upstart also recently announced loans on the books have peaked. You can see this reflected in their Q1 2023 results. Management confirmed on the conference call that they have no intention for loans on the books to surpass 1 billion again.

Upstart is selling backlogged unsecured personal loans off their balance sheet, and this move will be further accentuated in Q2 as Castlelake’s $4 billion in committed capital funding takes effect.

Loans on the books will continue to fall as Upstart proves its technology works. They will continue to fall as more committed capital is announced. They will continue to fall as aggregate loan demand rises into an easing macroeconomy.

The play on Upstart was quite simple. If you believed they would go bankrupt, which was never a scenario if you were confident the loans they underwrote were performing better than FICO as suggested by the data, you would short Upstart at any price.

If you did not believe bankruptcy was a question, you went long. In 2023 Upstart’s business has nearly 99 partners, vastly higher than the 57 they had a year ago. Upstart has more data, more funding, and more partners for this next bull run.

As a result of the extreme cyclical nature and fundamental misunderstanding of what Upstart does (you’re breaking up, I can’t hear you), many misconceptions have risen. I will now address the common two.

1.) Upstart is not a bank and they have no desires ever to become one.

Upstart works with banks and credit unions instead of against them through their AI lending marketplace which serves as a loan demand aggregator. They currently primarily serve personal loans, but are looking to expand more into the ABS markets. People apply for an Upstart loan on Upstart.com and are then redirected to one of Upstart’s 99 partners. (Soon to be more. Girouard has said adoption will come quick and fast (that’s what she said.))

This business model is great for three distinct reasons.

Upstart gathers brand recognition for the loans (which often serves underrepresented groups).

Upstart, in normal times, takes no credit risk as the lender is one of their partners.

By partnering with banks, Upstart gets access to otherwise hard to get advantages. These include lower cost of capital (customer deposits) and better consumer trust (brand loyalty). Because the cost of capital is so low for banks, Upstart is able to apply more affordable APRs to their products which results in higher conversion rates.

Thank you Brad,

for the following statistic, “(Upstart) enjoys a 15% higher conversion rate every time it lowers an APR offer by 1%.” So now we can begin to see how this all comes together. Upstart provides a solution that is better for banks & borrowers.2.) In traditional times, Upstart is not a lender.

The cyclicality Upstart faces has resulted in many false narratives floating around about the stock. The largest misconception that I constantly see about Upstart is that they are a lender. Upstart is a lending platform that connects borrowers with partnered lenders. Upstart’s goal is direct borrowers to banks and credit institutions while helping them better assess risk. Failure to do so and keeping loans on the books gives them credit risk and, by definition, a lender. But, this is not how Upstart typically operates. This is what we have seen recently and is a large contributor as to why the share price has fallen from $400. In theory, Upstart can originate and sell as many loans as humanly possible to an infinite number of banks. It is extremely leveraged and the sky is the limit.

Extra - Cross River Bank.

CRB, a fintech and crypto friendly bank, is a large customer of Upstart, and in 2021 they originated 55% of Upstart’s loans and accounted for 56% of revenue.

“In the year ended December 31, 2022, CRB originated 51% of the loans facilitated on our platform and fees received from CRB accounted for 45% of our total revenue,”(Upstart, 2022 10k).

That’s a 7.2% decrease in loan origination % and a 19.6% decrease in total revenue % year over year. Revenue concentration risks are falling and Upstart’s exposure to Cross River Banks continues to slide.

Cross River Bank received a consent order from the FDIC on March 8th, 2023 that was made public April 28th, 2023. Twitter was quick to catch onto this news and the Upstart FUD spread like wildfire.

Here are the facts.

The FDIC accused CRB of unsafe lending practices (did not specify if they were personal loans or crypto related, could have been either). CRB entered a consent agreement neither accepting or denying the accusations but instead agreeing to change practices moving forward.

Upstart has said multiple times their revenue concentration risk will continue to fade into the distance as they add more partners. The data supports this. Additionally, it is clear the “unsafe lending practices” do not involve Upstart, as by now, CRB would have received another notice for failure to comply. Some of the deadlines given by the FDIC had 30-day deadlines. Upstart also gave no inclination that their relationship with CRB was chaning or at the crossroads.

The day this headline went out the share price was roughly $14. It is now $54, only a 285% increase. Ouch. Sorry, shorts.

7.) Why Legacy Banks Can’t Do This.

One of the biggest questions regarding Upstart is “Why can’t legacy banks do this?”

Big banks have lots of data right? Well, that data is completely useless if they do not have a model that can understand it and put it to use effectively. This is no easy task, it’s one Upstart has been working on since 2012.

“Model accuracy improved as much in last seven months as prior 2.5 years,”(Upstart, Q4 2022).

Banks would have to hire huge teams to work on product development, which would take years to sophisticate. It is a much better idea for them to outsource to Upstart and pay a small fee. Upstart has a market cap of roughly $4 billion at the time of writing. It is more likely that Upstart will be bought out before any large bank spends billions trying to create its own machine-learning program.

Additionally, all of Upstart’s partners are HUGE beneficiaries of Upstart’s marketing and brand exposure. Reference their Trustpilot reviews which I’ll share again here. Borrowers LOVE Upstart.

Let me say that again. Borrowers LOVE their “Lender” (in this case, lending platform ^.^). Like, what the hell? How is that possible?

It’s somewhat similar to SoFi in the sense that SoFi has people excited about banking. Like what? How is that even possible, nobody likes banking. People want to have a loving family, great job, get drunk on the weekends, and of course boast about how much they love their lender. Wild times.

SoFi and Upstart are doing fintech right! Get customers excited and provide great customer service.

For comparison, here are legacy banks’ Truspilot reviews.

These companies’ reviews are so bad that they don’t even claim their profiles.

Here’s your latest Bank of America review, “Would give 0 stars if I could, wont give me my hard earned money, randomly closed my account, lied about when the money I deposited would be available (I still haven’t gotten it).” - Unhappy customer :(

Here’s Upstart’s latest review, “Holy Cow! Just went through a long drawn out nightmare with Universal Credit who is also Upgrade (confusing since they are separate offers on Credit Karma) - NEVER again!

Upstart was fast efficient and so easy! A ++++ experience! Highly recommend!!” - Happy customer :)

I mean, guys, come on. I feel like some of you are going to dismiss this for whatever reason but ratings don’t lie. Legacy banks are outdated and well behind the curve. They refuse to switch to Upstart despite the data showing they could approve more borrowers, at lower APRs, with lower default rates! What makes you think they will build their own model? If they do, they will be so late.

8.) My TLDR Thesis

Upstart's AI-powered lending platform is more accurate than traditional credit scoring models, which allows the company to offer loans to borrowers who would not be able to qualify for loans from traditional lenders. This expands access to credit and helps borrowers build their credit history.

Upstart has addressed the cyclicality of its business by ramping up its auto program and entering the HELOC market. The company has also acknowledged that putting loans on its balance sheet was a mistake, and it is working to fix this moving forward.

Upstart has taken steps to improve its profitability, including cutting 20% of its workforce, giving its models more data, and securing more partners. The company is on track to achieve adjusted EBITDA breakeven in the next quarter, and it is well-positioned to be profitable at a smaller scale of loan origination.

Upstart has the potential to originate as many loans as possible, given the right funding. The fact that Castlelake has invested up to $4 billion in Upstart loans is a testament to the accuracy of Upstart's platform. With Federal Funds Rate near its peak, Upstart is well-positioned for growth.

I bought Upstart at $16.76. It was a no-brainer. Today, at $54, the market has finally realized its potential. The mispricing is gone and it is up to management to prove their worth.

Dave, if you’re reading this, I have spent an ungodly amount of time studying and reviewing your company. I have been chastised, laughed at, and ridiculed because I believed in Upstart when nobody else did. I can see the path Upstart is on, and I truly believe in your mission and your team. I will not sell my shares until you break my trust. Right now, there isn’t anyone better suited for the job than you. Keep it up.

Acknowledgments

This article wouldn’t have been possible without the help of many.

To start, I would like to give a huge thank you to my friend Owen, OwenDeBoard2 on Twitter, as without him, I would not own Upstart. Owen has been a close friend and a great partner to bounce ideas off of. He is extremely intelligent and has also called the bottom on Rocket Labs, $RKLB, which has since doubled.

Additionally, thank you to Brad,

, for writing such an excellent deep dive that I could use as a reference in presenting my work.I would like to additionally thank some friends in my Twitter circle, Veganhippo21, Vasilist, Frugalbuck, you guys have stuck with Upstart through it all and deserve the same, if not more, credit than I.

Thank you for reading. Please follow me on Twitter - HenryInvests.

W article. W Henry. W Upstart.